In a recent announcement, the Biden administration revealed that it will provide $39 billion in student debt relief to 804,000 borrowers. This relief comes as a result of administrative fixes that accurately account for qualified monthly payments under existing income-driven repayment plans.

Education Secretary Miguel Cardona expressed the need for this action, stating, “For far too long, borrowers fell through the cracks of a broken system that failed to keep accurate track of their progress towards forgiveness.”

Currently, there are various income-driven repayment plans available to borrowers with federal student loans. These plans determine payments based on income and family size, regardless of the total outstanding debt. After reaching a forgiveness threshold of 20 or 25 years, any remaining balance is forgiven.

Cardona emphasized that by rectifying past administrative failures, the administration ensures that everyone receives the forgiveness they deserve. This commitment extends to public servants, students who were defrauded by their colleges, borrowers with permanent disabilities (including veterans), and now, those affected by the historical failures in counting qualifying payments accurately.

The Department of Education acknowledged that there were previous errors and miscounts in qualifying payments made by borrowers. This action specifically addresses those issues and will benefit individuals with Direct Loans or Federal Family Education Loans held by the department.

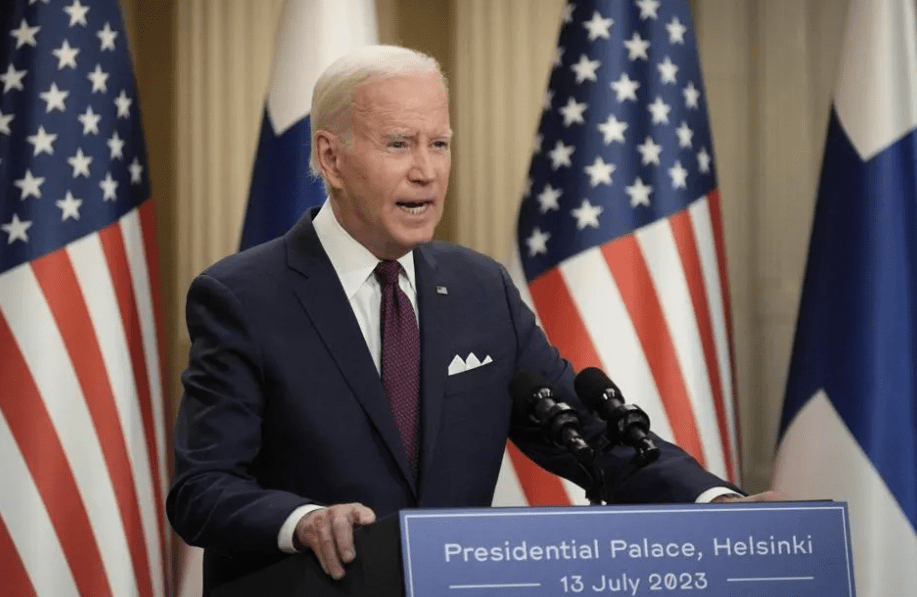

With student loan repayments set to resume in October after the pandemic-related pause, this announcement underscores President Joe Biden’s promise to provide debt relief to millions of Americans. The Biden administration has already canceled more debt during his tenure than any other president, with over $116.6 billion in student debt relief approved for over 3.4 million Americans.

However, not all have been supportive of these efforts. Republican-led states, conservative groups, and some Republican lawmakers have raised objections and filed legal challenges against the president’s student loan forgiveness program. Representative Virginia Foxx, chairwoman of the House Education and the Workforce Committee, expressed her concerns, accusing the president of undermining the postsecondary education financing system for political gain.

President Biden responded to his critics, defending his actions by emphasizing the relief promised to borrowers who had been making payments for decades. He stated, “The disregard for working and middle-class families is outrageous.”

While the Supreme Court recently struck down Biden’s loan forgiveness program that aimed to provide up to $20,000 in one-time federal student debt relief, the administration remains committed to finding alternative solutions and making debt cancellation more accessible. President Biden announced a “new path” forward on debt relief following the Supreme Court’s decision, and his administration continues to explore other avenues for debt relief.

In addition to today’s actions, the Department of Education is implementing a separate and significant change to the federal student loan system. The new income-driven repayment plan, called SAVE (Saving on a Valuable Education), will be introduced this summer and fully phased in next year. This plan, which has undergone a formal rulemaking process, aims to reduce monthly bills by half and forgive remaining debt after at least ten years of payments.

The Biden administration remains committed to fighting for student debt relief and believes it will benefit both individuals and the economy. The details of the upcoming plan and the on-ramp period to help borrowers transition into repayment without penalties are yet to be announced, but the administration assures borrowers that they will continue using all available tools to provide the needed relief and help borrowers achieve their dreams.